What is a stop limit order and when should you use it

Table of Contents

Table of Contents

Are you tired of trying to catch a falling stock? Do you wish there was a way to place limits on your losses without constantly monitoring the market? That’s where Stop Limit On Quote comes in.

When investing in volatile stocks, it can be challenging to determine when to sell without incurring significant losses. Stop Limit On Quote is a market order that protects your investments by simultaneously placing a stop loss order and a limit order. This type of order guarantees that your stock is sold when it reaches a specific price limit, protecting you from further financial loss.

The primary target of Stop Limit On Quote is to minimize losses by placing a sell order that’s not too low, leading to no profits, or too high, incurring substantial losses.

In summary, Stop Limit On Quote is a fantastic way to manage your risk and protect your investments. By placing simultaneous stop loss and limit orders, you can maximize your investment gains while minimizing the potential for losses.

What is the Target of Stop Limit On Quote?

The main target of Stop Limit On Quote is to limit losses by simultaneously placing a stop loss order and a limit order. By doing this, you can secure a specific price at which your stock will be sold, without any risk of further loss.

As a personal experience, I once invested in a volatile stock, which experienced a significant drop in price. I was worried about incurring significant losses but didn’t want to monitor the stock closely. Using Stop Limit On Quote, I could secure a specific price at which it would be sold without having to constantly check the market.

How Does Stop Limit On Quote Work?

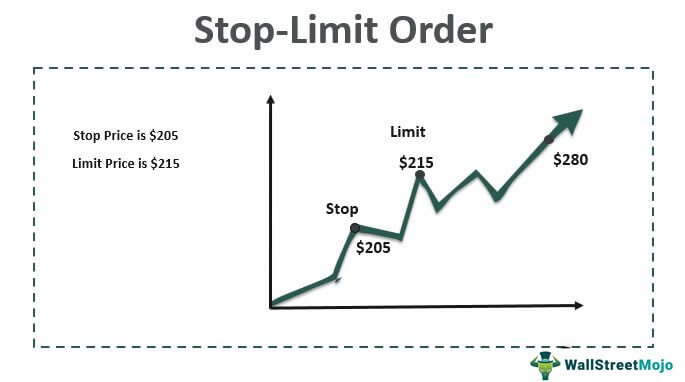

The Stop Limit On Quote order is a market order that places two orders simultaneously. First, it places a stop loss order at your designated stop price, which is the price at which you would like to sell your stock if the market goes against you. Second, it places a limit order at the designated limit price, which is the price at which you would like to sell your stock if the market goes in your favor. When these two conditions are met, the stock is sold, and the order is executed.

It’s important to note that Stop Limit On Quote orders do not guarantee that your stock will be sold at the exact price you set, as market conditions can fluctuate rapidly. It only guarantees that your stock will be sold at a certain price range.

Stop Loss Orders vs. Stop Limit Orders: What’s the Difference?

Stop loss orders and Stop Limit On Quote orders may sound similar, but there are critical differences between them. Stop loss orders are orders that sell a stock when its price reaches a certain point. This type of order does not guarantee the price at which you will sell your stock.

On the other hand, Stop Limit On Quote orders place both a stop loss order and a limit order, which guarantees that your stock will be sold if the price reaches the limit order price. In essence, Stop Limit On Quote orders provide a safety net for volatile stocks, as they minimize losses while maximizing gains.

Advantages and Disadvantages of Stop Limit On Quote Orders

Stop Limit On Quote orders have several advantages, such as limiting losses while maximizing gains, providing a safety net for volatile stocks, and enabling you to be hands-off with your portfolio. However, they also have some disadvantages, such as not guaranteeing the execution of the order(s), limits on order placement when trading before or after market hours, and potential losses due to rapidly changing market conditions.

Conclusion of Stop Limit On Quote

Stop Limit On Quote orders are an excellent way to protect your investments while maximizing gains by placing both a stop loss order and a limit order. By understanding how these orders work and their advantages and disadvantages, you can make informed investment decisions to help secure your financial future.

Question and Answer

Q: Can I use Stop Limit On Quote for all types of stocks?

A: Yes, you can use Stop Limit On Quote for all types of stocks, particularly volatile stocks that require constant monitoring.

Q: What happens if the stock price drops below the stop price?

A: If the stock price drops below the stop price, the Stop Limit On Quote order is triggered, and the stock is sold at the limit price, providing a safety net for investors.

Q: Can I place a Stop Limit On Quote order before or after the market hours?

A: Yes, you can place a Stop Limit On Quote order before or after regular market hours. However, there are limitations on orders placed during these times, so it’s essential to check with your broker first.

Q: How often should I monitor my Stop Limit On Quote order?

A: You don’t need to monitor your Stop Limit On Quote order constantly. Once you have set the stop and limit prices, the order will be executed automatically once the stock reaches either of these prices, providing you with peace of mind.

Gallery

Stop-On-Quote Vs Stop-Limit-On-Quote Orders • Money Rook

Photo Credit by: bing.com / etrade

What Is A Stop-Limit Order And When Should You Use It? - TheStreet

Photo Credit by: bing.com / stop limit order should thestreet

What Are The Difference Between Stop Loss And Stop Limit Order | The

Photo Credit by: bing.com / btcc

Kyle Maynard Quote: “Know Your Limits, But Never Stop Trying To Break

Photo Credit by: bing.com / limits break maynard kyle know stop quotes quote trying never them but die such thing hard friends wallpapers quotefancy maas

Stop Limit Order (Definition, Example) | How Does It Work?

Photo Credit by: bing.com /